Markets do not move in straight lines. They rise, fall, and rise again – sometimes faster than we would like. For new investors, these swings in a volatile market can feel unsettling. You open your portfolio one day and everything looks great, and the next day your balance has dropped. It feels unfair and scary.

But this is not a sign that something is wrong. Volatility is simply part of how markets behave. Prices move up and down because investors around the world are constantly reacting to news, emotions, and expectations. The good news? You do not have to react the same way.

If you can learn to stay calm during market turbulence, you gain one of the most valuable skills in investing: patience.

Volatility Is Normal

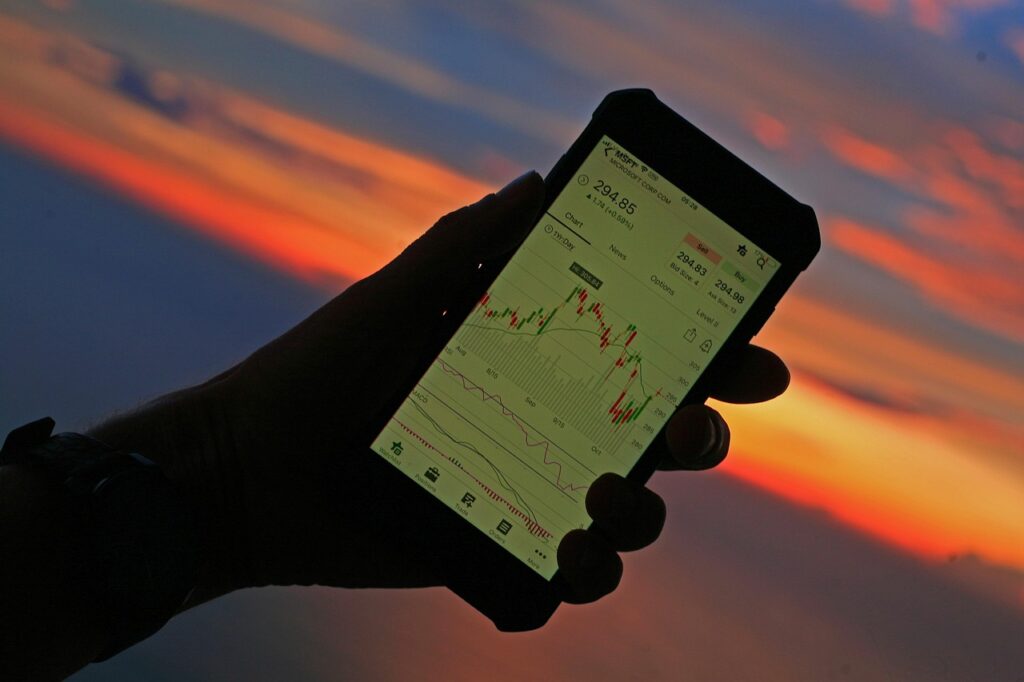

The word “volatility” often sounds negative, but in truth it just means “movement.” Markets move because the world changes — new technologies appear, economies grow or slow, interest rates rise and fall. Over short periods, these movements can look chaotic. But when you look at a chart that spans decades, the pattern is surprisingly clear: despite all the noise, markets have tended to grow over time.

If you had invested in the global stock market 20 years ago, you would have lived through financial crises, pandemics, and recessions — yet the overall trend remains upward. Each dip was followed by recovery, and each recovery set new records. Volatility, as uncomfortable as it feels, is the price we pay for long-term growth.

The key is not to avoid volatility, but to manage your emotions when it happens.

Stay Calm and Stay Invested

When markets fall, our instincts tell us to do something. Selling feels safe, like grabbing an umbrella when it starts to rain. But in investing, that instinct can work against you. Selling in panic means locking in your losses, and you might miss the rebound that often follows soon after.

Think of investing as a long journey through changing weather. You do not cancel your trip because of a single rainy day. You keep going, knowing the sun will come out again. The same mindset works with your portfolio.

Many studies have shown that investors who stay invested through market swings end up with better results than those who try to jump in and out. Missing even a few of the market’s best days can significantly reduce your returns.

So when the market drops, remind yourself: this too shall pass. Keep your plan running and trust the process, even in a volatile market.

Think Long Term

The stock market rewards time, not timing. The longer your money stays invested, the more you benefit from compounding — that quiet force that turns small returns into big growth over years and decades.

Trying to guess when to buy or sell is almost impossible, even for professionals. Instead of chasing the perfect moment, focus on time in the market. Let your investments work quietly in the background while you focus on living your life.

A long-term perspective also helps you seea volatile market for what it really is: temporary noise. Short-term drops might feel dramatic now, but ten years from today, they will likely appear as small ripples on a much larger upward trend.

Diversify to Reduce the Stress

One of the most effective ways to stay calm during volatile times is diversification. When your money is spread across many companies, industries, and countries, no single event can hurt your portfolio too much.

ETFs make this simple. A global ETF, for example, can include hundreds or even thousands of companies. If one company struggles, others balance it out. This built-in mix protects you from extreme ups and downs and keeps your portfolio more stable.

Diversification does not remove risk entirely, but it makes the ride much smoother – and emotionally, that is worth a lot.

Practical Tips for Uncertain Times

There are a few practical things you can do to handle market swings more easily:

- Avoid checking your portfolio too often. Watching prices every day fuels anxiety and encourages emotional decisions. Once a month or even once a quarter is enough.

- Keep your savings plan running. Automatic monthly investments take emotion out of the process and let you buy more when prices are low.

- Focus on what you can control. You cannot control the market, but you can control your spending, saving, and patience.

- Remember your goals. The reason you started investing – retirement, security, freedom – matters more than short-term noise.

Building calm habits now will help you stay consistent when volatility strikes again, which it always will.

Mindset Matters

Successful investing is not about predicting the future; it is about managing yourself. The right mindset makes all the difference. A volatile market is not a threat but a natural part of the journey.

If you can stay invested when others panic, you gain a quiet advantage. You allow your money to recover and grow while emotional investors sell low and buy back high.

Remind yourself that every market dip is also a potential opportunity – prices are simply “on sale.” As long as you invest in quality, time and patience remain your strongest allies.

The Market Might Shake, But Your Strategy Doesn’t Have To

There will always be noise, news, and nervous days. But none of those should define your investment journey. Your real strength lies in consistency.

Set a plan that fits your goals, invest regularly, and let time do its work. The more you trust your process, the less power market swings have over you.

Remember: volatility is temporary, but your long-term goals are not. Stay calm, stay focused, and stay invested – that is how wealth quietly grows.

Disclaimer

The information in this article is for educational purposes only and does not constitute financial advice. Always do your own research or consult a qualified financial advisor before making investment decisions. Past performance does not guarantee future results, and all investments carry risk, including the potential loss of capital.